As {the marketplace} for archery and fishing gear expands past your native sporting items retailer to the web, plenty of abroad direct-to-consumer merchandise are bypassing the federal rod-and-gun tax that helps wildlife and fisheries conservation in America.

That’s the discovering of an audit launched earlier this month by the Authorities Accountability Workplace that recommends Congress think about making on-line marketplaces, similar to Amazon, Alibaba, and Walmart.com, liable for gathering the ten to 11 p.c excise tax on archery and fishing sort out imports that they facilitate.

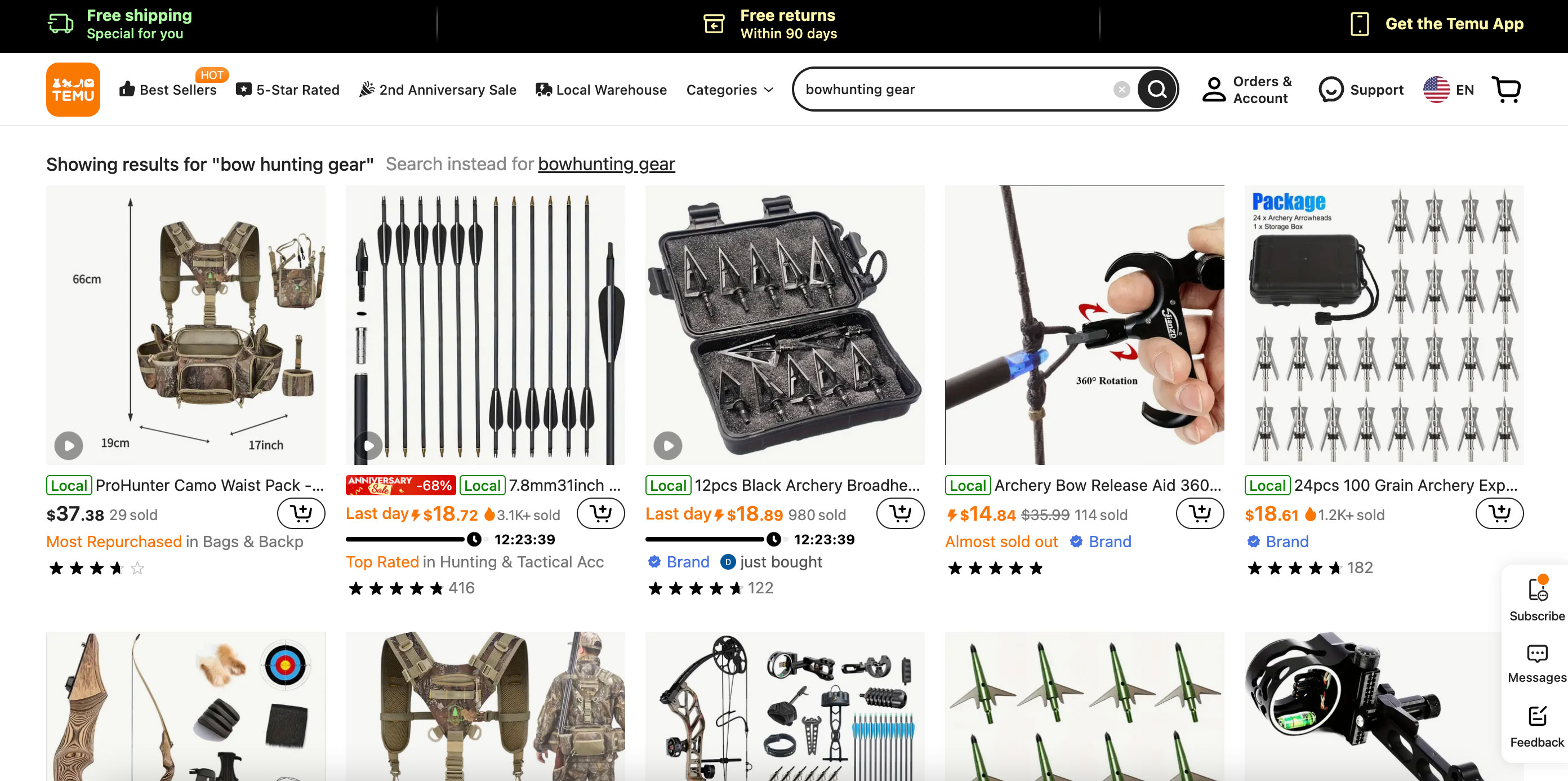

Arrows, looking bows, and fishing lures (amongst lots of of different product classes) which might be manufactured abroad and shipped on to customers are a sizeable supply of “leakage” within the tax that U.S. producers pay, which is basically liable for the considerable fish and wildlife that American hunters and anglers pursue.

On an annual foundation, these alternative-sourced fishing and bowhunting merchandise siphon between $6 and $17 million yearly from the tax fund that their home opponents are required to pay. (These excise tax applications are generally generally known as Pittman-Robertson on the looking and firearms aspect and Dingell-Johnson on the fishing aspect.)

Latest analysis seemed solely at archery and sportfishing gear; there’s no equal examine of leakage in non-archery looking gear, however as a result of firearms and ammunition are extremely regulated, the marketplace for foreign-made, direct-to-consumer merchandise is probably going comparatively small in comparison with the largely unregulated archery and fishing markets.

The whole concern of tax “leakage” is a helpful reminder of how and why these revenues have been established within the first place. The system is meant to work as follows: The U.S. Division of the Treasury collects tax income from producers and importers of looking and fishing gear. That income is distributed by the U.S. Fish and Wildlife Service to state fish-and-game companies to fund sustainable fish and wildlife administration, public entry, and habitat investments. Via this course of, the Pittman-Robertson Act generated roughly $1.2 billion in wildlife restoration funding in 2023, and the the Dingle-Johnson Act generated roughly $425 million in sport fish restoration funds.

Learn Subsequent: The Surge in Gun and Ammo Gross sales Has Created a Growth in Wildlife Conservation Funding

However when these taxes have been established (within the Nineteen Thirties for the hunting-gear tax and in 1950 for the fishing-tackle tax), the revenue-collection mechanism didn’t account for on-line retailers or direct-to-consumer product success by international corporations that bypasses conventional tax collectors.

“The tax, whether or not we’re speaking Pittman-Robertson on the looking aspect or Dingell-Johnson on the fishing aspect, is a producers’ tax,” says Dan Forster, vp and chief conservation officer for the Archery Commerce Affiliation. “The conventional state of affairs is that when a U.S. producer produces a product and both sells it in bulk to a wholesaler or sells it to an enormous retailer, the tax is levied at that first level of sale.”

In different phrases, customers don’t see the tax itemized on a receipt as a result of it’s already been levied and picked up earlier than sporting items seem on retailer cabinets. However the costs customers pay is adjusted upward to cowl the tax, which is 11 p.c on bows and something that touches a bow, together with strings, peeps, sights, rests, stabilizers, broadheads, and quivers. For fishing gear, the tax is 10 p.c on rods, reels, fishing line, lures, touchdown nets, and spear weapons.

“It’s hidden in the price of the merchandise, so you’ll be able to’t inform it’s there,” Forster says of the tax. “That’s a part of our downside. Individuals don’t actually perceive that the producers are paying in to our excise tax fund, and that it’s going for good issues.”

However the onset of e-commerce has created work-arounds that permit international producers and the businesses that facilitate sale of their merchandise to U.S. customers to bypass tax assortment. Forster stresses that these shadow importers aren’t conspiring to keep away from paying the conservation tax, however moderately exploiting an oversight that needs to be addressed within the pursuits of consistency and equity.

He notes that on-line retailers like Amazon and Walmart.com can’t be outlined as importers, as a result of they hardly ever obtain and retailer the product. As an alternative, they facilitate the transaction between U.S. customers and abroad suppliers, however don’t truly contact the product, which is shipped immediately from the producer to the buyer.

“Within the case of an Amazon, there’s no actual importer of report,” says Forster. “The foundations don’t tackle a facilitator of commerce as a result of they’re antiquated. They weren’t developed to think about a state of affairs like now we have right this moment, and the GAO report mainly advised us that we will’t repair this with a regulation change. We’re going to wish a legislative change.”

If a legislative repair isn’t forthcoming, Forster says, the archery and sportfishing industries may foyer to scrap the conservation taxes altogether.

“It is a large deal for our group at massive,” says Forster. “The true concern is one among equity. We’ve U.S.-based corporations which might be paying this tax, and the expectation is that the cash collected is an funding in conservation and our business. However the different expectation is that it’s utilized pretty. When now we have a scenario the place international corporations are undercutting U.S.-based producers as a result of they’re not paying this conservation tax, they’re at a aggressive benefit. That’s not sustainable. We’ve advised Congress that if we will’t repair this factor and make it truthful and equitable, then it [P-R and D-J excise taxation] has to go away. Assist us repair this factor in order that we will keep the tax construction that has resulted in a lot profit for our group.”

Within the bowhunting class, the principle supply of “leakage” appears to be arrows, says Forster.

“There are different product classes which might be bypassing the system, however our members inform us that arrow shafts are far and away the [main] class” circumventing the tax.

“We estimate the leakage is a minimal of eight p.c of the $50 million in excise taxes that the archery business pays yearly,” says Forster. “Once you’re pondering of the U.S. authorities and its total tax assortment, that’s a rounding error. However in an business like ours, that’s a mean lack of a pair hundred thousand {dollars} per state, which implies a few full-time biologists or wildlife administration positions and possibly a capturing vary. And that affect is happening yearly that we don’t shut this loophole.”

Each the ATA and the American Sportfishing Affiliation have lobbied Congress to deal with the leakage by way of laws, because the Authorities Accountability Workplace report recommends. Forster says he’s pessimistic the legislative repair could be achieved this 12 months, however there may be little or no opposition to it. If it doesn’t move as a rider to a must-pass piece of laws within the present Congress, he’s hopeful it is going to move the subsequent Congress.

“We’re asking for precisely what the GAO examine stated, to maneuver the burden of the tax additional up the chain to the web market facilitator, who’s appearing very very similar to a standard importer and subsequently needs to be gathering and remitting the taxes on the merchandise they import,” says Forster. “Absent the importer, the tax needs to be collected on the first level of sale, which i] the top person, the buyer.”

Forster says the GAO examine seemed on the problem of requiring customers to pay the tax once they obtain sporting items immediately from a international producer. That is an unlikely resolution.

“Customers don’t know they’re responsible for the tax, for one, and there’s not loads of data on the IRS web site that explains how you can pay the tax,” says Forster. “And the GAO report additionally signifies that it prices one thing like $3.80 in administrative prices for every transaction to course of the tax, so in case you purchase a dozen lures and your tax invoice is .62 cents, everyone goes backward on that. Good tax coverage says we should always transfer the gathering burden up the chain if we will.”